A new study has shown the dramatic impact of climate risk on skyrocketing homeowners' insurance prices

Thu 27 Nov 2025 11.30

Photo: AAP Image/Dean Lewins

In a very detailed study, the Brookings Institute in the US has shown that much of the average increase in homeowners’ insurance premiums is driven by higher disaster risk and that the increases were concentrated in highest risk areas. Moreover, the price differentials driven by disaster risk has been increasing over time. In other words if you lived in a high risk area and were paying double the average premium some years ago you might be paying triple the average premium today.

One of the mechanisms involved has been the higher cost of reinsurance for retail insurance companies.

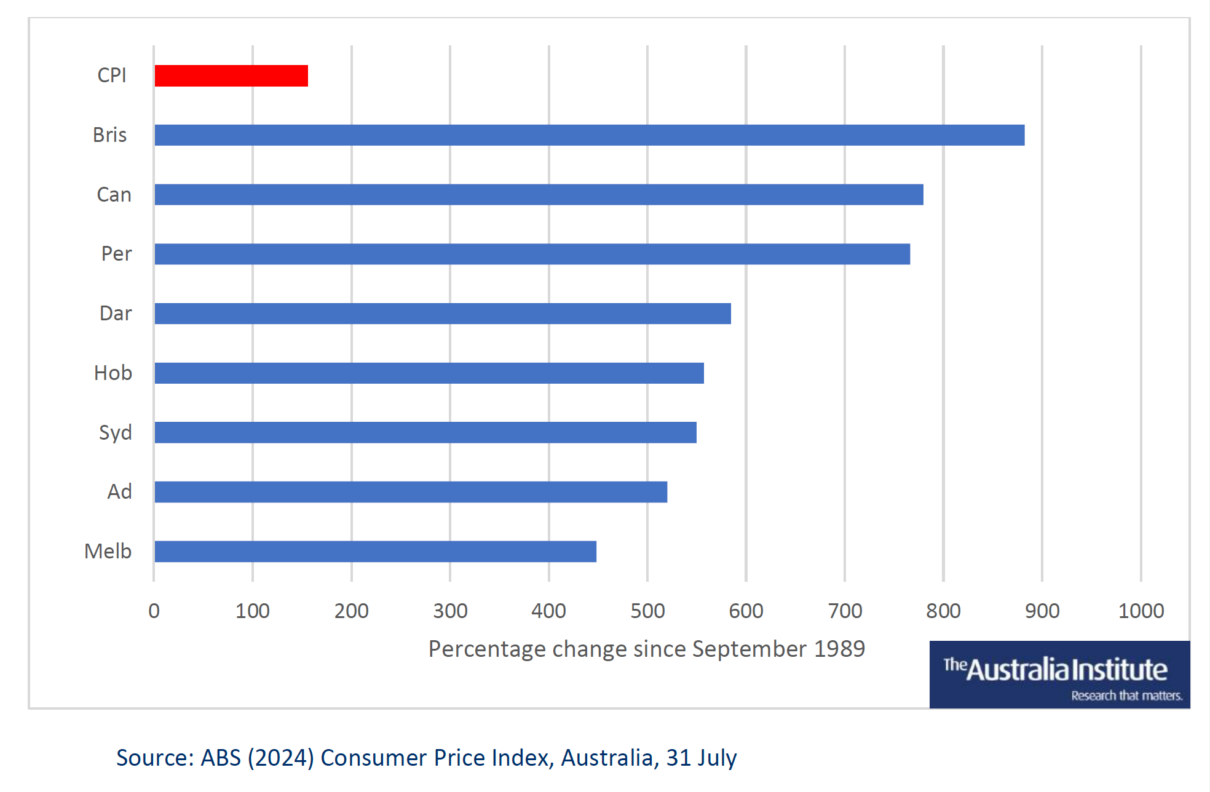

This study shows some of the things the Australia Institute pointed to in our earlier work on the costs to homeowners of climate change. The rapid increases in home insurance costs have been due to the increasing incidence of natural disasters driven in turn by climate change. Apart from price increases, in many parts of Australia, home and business insurance is unavailable or prohibitively expensive.

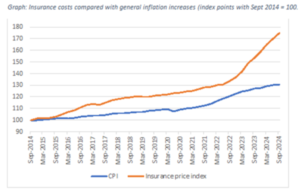

In the capital cities we showed insurance costs outpaced the general price level by more than five to one in Brisbane and almost three to one in Melbourne, the lowest of the cities. The graph below shows how insurance costs in capital cities have exceeded the increase in CPI over the last 35 years.

The Brookings Institute mention of reinsurance reminds us that there are only a few major reinsurers that operate world-wide. The Australia Institute earlier showed what that means; global reinsurers know that disaster risks are correlated throughout the world so events like California’s wildfires drive up prices throughout the world and that includes Australian insurance premiums.

Even climate change deniers would be aware of the increase in their home insurance over recent years.