The big four have now all reported their obscene profits for 2025 as they continue to dominate the Australian market

Tue 11 Nov 2025 12.00

Photo: AAP Image/James Ross

Yesterday the ANZ Bank released its 2025 Annual Report showing a pre-tax profit of $8.8 billion, complaining it’s a bit down on 2024. But it’s still among the billions and at the expense of its customers.

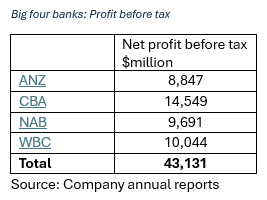

We now have 2025 results for all the big four banks which are included in the following table.

ANZ is the smallest of the big four banks and in turn its profit is lower than the other three, but banking is so profitable in Australia that being the smallest of the big four still makes ANZ bigger than all but two other Australian companies, BHP and Newcrest.

Combined the big four banks made profits of $43 billion and, as shown in the table below, between them they control 74 per cent of the home mortgage business in Australia. While the CEOs have been complaining about ‘fierce competition’ in the morale market of late, the facts make a mockery of their faux fears.

Bank profits come at the expense of ordinary Australians, particularly homebuyers. Australia Institute research shows the big four banks make around $213,480 profit over the 30-year life of an average-sized first home buyer mortgage. And these figures don’t even include the extra profit banks make on any other savings or credit card accounts, transaction fees, kickbacks on insurance they sell your or the ridiculous prices they charge to get a bank cheque.

Even if you do not bank with one of the big four you still contribute to their profit every time you use a card to pay for something online or in a shop.

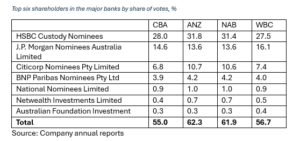

In the past the Australia Institute has also questioned the independence of the big four banks from each other, especially given that the same shareholders turn up in their list of top shareholders. For example, the following table shows the major shareholders of the big four presented in their latest annual reports.

The companies listed here may not be the beneficial owners, but, as nominee companies they control the vote of the shareholders they represent. For example, HSBC Custody Nominees controls well over a quarter of the vote in each of the big four banks. Together the top six shareholders control 55.0% of the Commonwealth Bank through to 62.3% of the ANZ. The size of these common ownerships and their hold on the big four banks makes us wonder how competition can ever take place.

The lack of competition among the big banks has come at the cost of homeowners, and their profits from home loans cannot be justified on the basis of risk. Take the ANZ’s results as an example. Its worldwide loans are $830 billion and its credit impairment charge for bad and doubtful debt is just $435 million, that is it expects just 0.052% of its total loans default… that’s less than a tenth of one per cent!

The Albanese Government has huge majority in parliament, and in turn a huge opportunity to pass new laws to help take the burden off the people who need help the most.

A small super profits tax, the Major Bank Levy, was imposed by the Coalition Government back in 2017 and it raised just over $1.8 billion in 2024-25. This small Coalition tax has clearly done little to dent the profits, or the market share of the big banks.

So, what is stopping the Albanese Government from going further than the Coalition? Why not increase the rate and collect $5 billion per year from the big banks and use it to help build more public housing to push rents down for everybody? Surely if it’s okay for the Coalition to impose a new tax on the banks without taking the idea to an election there is no reason why Labor can’t increase it?